Small Call to Action Headline

Credit Repair And Education

Understand Your Credit. Know Your Rights. Make Informed Decisions.

At DB Credit Repair, we believe credit education is the foundation of long-term financial confidence. This educational is designed to help you understand how credit works, what your rights are, and how informed actions—not shortcuts—support healthier credit outcomes.

This education is compliance-focused, and intended to empower consumers with knowledge.

Why Credit Education Matters

Many consumers struggle with credit not because they are irresponsible, but because they were never taught how the system works.

Credit education helps you:

● Understand how credit scores are calculated

● Recognize inaccurate or unfair reporting

● Learn your legal rights as a consumer

● Avoid costly credit mistakes

●Set realistic expectations

● Informed consumers make better financial decisions.

Start with clarity. Schedule a free credit education consultation today.

How Credit Scores Are Calculated

Understanding how credit scores are calculated helps you make smarter financial decisions and avoid common mistakes.

The Five Core Credit Factors

While scoring models vary, most credit scores are influenced by the following educational factors:

Payment History

Your record of on-time payments. Late payments, defaults, and delinquencies can negatively affect your score.

Credit Utilization

The percentage of available credit you are using. High balances relative to limits may signal increased risk.

Credit History Length

The age of your credit accounts, including the oldest account and average account age.

Credit Mix

A variety of account types (credit cards, installment loans, etc.) may contribute positively.

New Credit Activity

Frequent applications or new accounts within a short period can temporarily impact scores.

We educate clients on how these factors interact and how responsible credit behavior supports long-term improvement.

Want help understanding how these factors apply to your personal credit profile?

Book a credit education session.

Consumer Credit Laws You Should Know

Credit education includes understanding your legal rights. Federal laws exist to protect consumers from inaccurate or unfair reporting.

Key Consumer Protection Laws

Fair Credit Reporting Act (FCRA)

Gives consumers the right to dispute inaccurate, incomplete, or unverifiable information.

Fair Debt Collection Practices Act (FDCPA)

Regulates how third-party debt collectors may contact and communicate with consumers.

Fair Credit Billing Act (FCBA)

Provides protections related to billing errors on credit accounts.

Truth in Lending Act (TILA)

Requires clear disclosure of credit terms and costs.

Our consultants help clients understand how these laws apply to their credit profiles and dispute rights.

Learn how consumer protection laws apply to your credit situation.

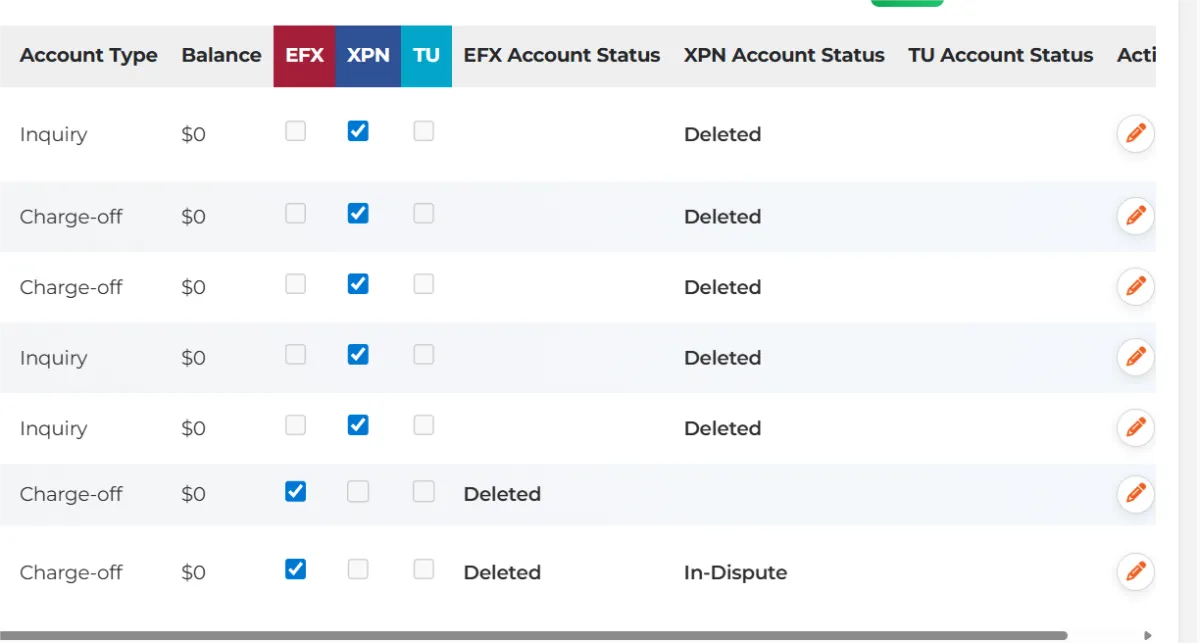

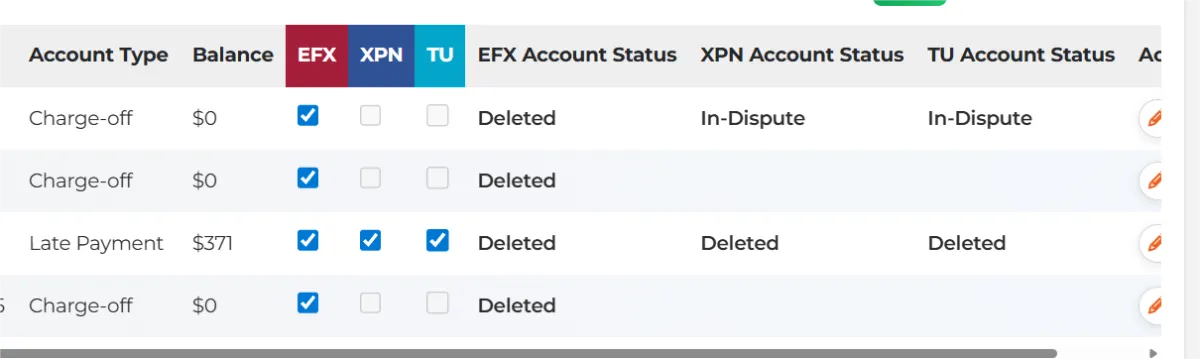

The Credit Dispute Process

Many consumers are unfamiliar with how disputes work. Education helps remove confusion and unrealistic expectations.

Educational Overview of the Process

1. Credit reports are reviewed for accuracy and consistency

2. Questionable items are identified based on documentation

3. Disputes are submitted in compliance with applicable laws

4:Credit bureaus and furnishers investigate and respond

5: Reports are updated based on verification results

We educate clients throughout the process so they understand timelines, responsibilities, and possible outcomes.

Request an educational credit report review to better understand your options.

How Long Do Negative Items Stay on Credit Reports?

Negative information does not remain forever. Understanding reporting timelines helps reduce anxiety and misinformation.

Common Reporting Timeframes

Late payments: up to 7 years

Collections: up to 7 years

Charge-offs: up to 7 years

Foreclosures: up to 7 years

Bankruptcies: 7–10 years depending on type

Tax liens: varies based on status and reporting rules

Reporting timelines may vary based on circumstances and verification.

Unsure how long items on your report should legally remain?

Get an educational timeline review.

Identity Theft & Fraud Education

Identity theft can severely damage credit if not addressed promptly.

Educational Guidance Includes:

How fraudulent accounts appear on credit reports

Steps to document identity theft properly

Understanding fraud alerts and credit freezes

Monitoring for suspicious activity

Early detection and education are critical to limiting long-term damage.

Credit Repair vs. Credit Building

Many consumers confuse these two concepts.

Credit Repair

Focuses on reviewing and disputing inaccurate, incomplete, or unverifiable information.

Credit Building

Involves responsible financial habits such as timely payments, proper utilization, and account management.

Long-term success requires education in both areas.

What Are Defaults?

Negotiating with Creditors

The Power of Disputing Errors

Rebuilding After Defaults

How Defaults Affect Your Credit

Preventing Future Credit Issues

Ready To Get Started Sign Up Now For Your Free Credit Analysis Today!

Let us help you reclaim your financial peace of mind

Why Choose DB Credit Repair?

Understanding how credit repair, debt resolution, and financial protection work is crucial for long-term financial success. This guide provides actionable strategies to help you rebuild credit, settle debts, and prevent fraud.

What Sets Us Apart

One-on-One Credit Consulting

Education-First Approach

Transparent Pricing & No False Promises

Federal Law–Compliant Dispute Process

Removal validation and reporting updates

Ongoing Credit Monitoring Support

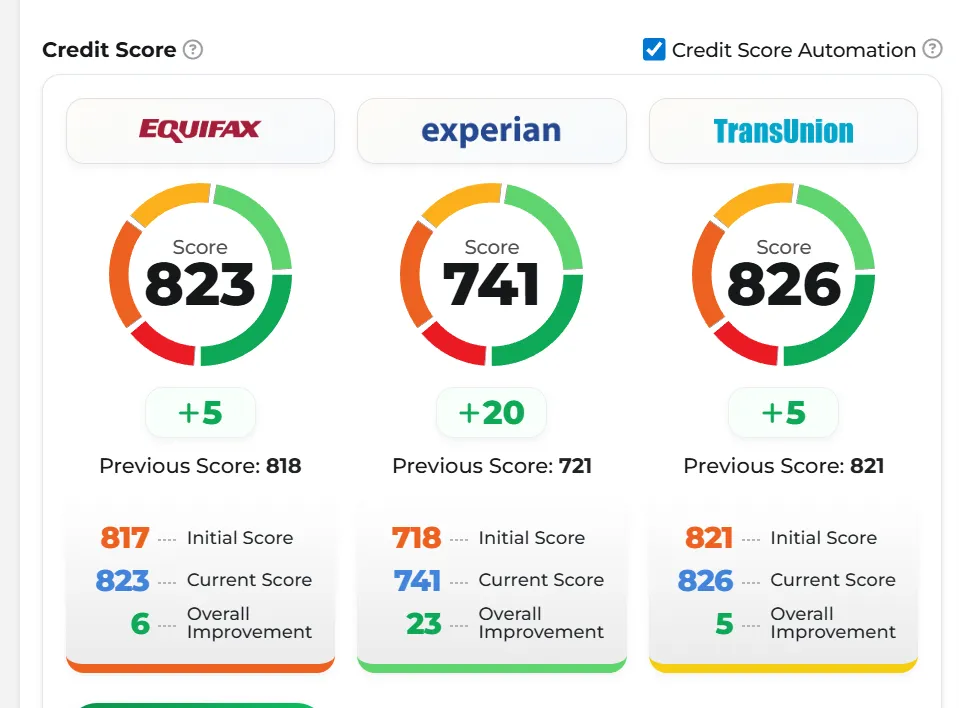

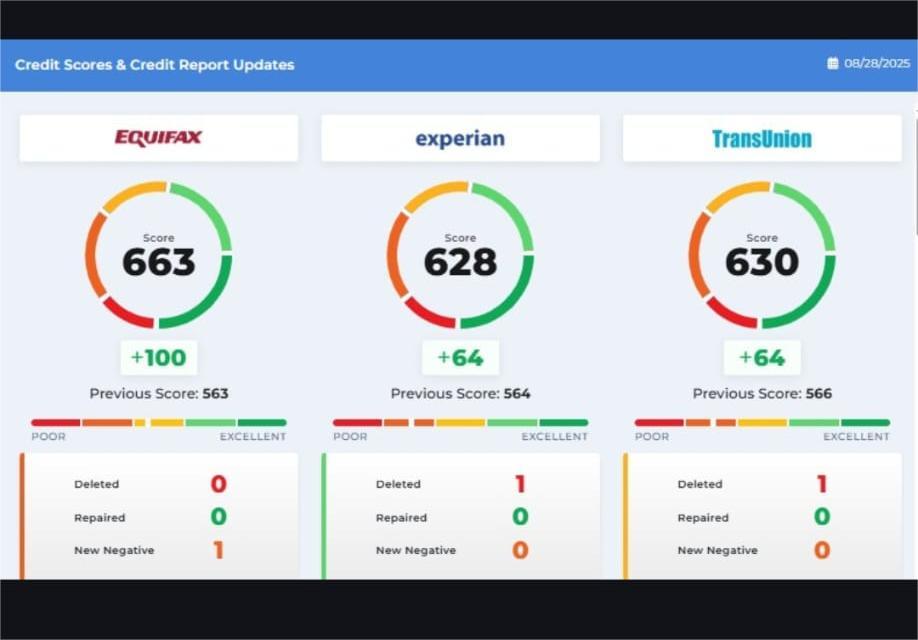

How Our Credit Repair Process Works

Step 1

Free Credit Review

We analyze your credit reports to identify inaccurate, outdated, or unverifiable information.

Step 2

Personalized Credit Plan

You receive a tailored action plan outlining dispute strategies and credit-building recommendations.

Step 3

Dispute & Monitor

We assist with compliant disputes and monitor bureau responses while keeping you informed.

Step 4

Rebuild & Protect

We help you understand how to maintain and strengthen your credit moving forward.

Start With Credit Analysis

Click to Learn More What We Help Remove From Your Credit Report

All services are performed in accordance with federal consumer protection laws.

Frequently Asked Questions (FAQ)

What is the difference between credit education and credit repair?

Credit education focuses on helping consumers understand credit reports, scoring factors, and consumer protection laws. Credit repair involves disputing inaccurate, incomplete, or unverifiable information in accordance with applicable laws. Education supports better decision-making in both areas.

Can negative items be removed from my credit report?

Some negative items may be removed if they are inaccurate, incomplete, or unverifiable under the Fair Credit Reporting Act (FCRA). Accurate and verifiable information generally remains for the legally allowed reporting period.

How long does the credit dispute process take?

Dispute timelines vary. Credit bureaus typically have up to 30 days to investigate disputes once submitted. Outcomes depend on verification results and individual circumstances.

Will checking my credit or speaking with a consultant hurt my score?

No. Reviewing your credit report or speaking with a credit education consultant does not impact your credit score. Only certain types of credit applications may affect scores.

Do I need credit monitoring to benefit from credit education?

Credit monitoring is not required for education, but it can help consumers stay informed about changes, potential errors, or suspicious activity on their credit reports.

What if I’m dealing with identity theft or fraud?

Education includes guidance on recognizing fraudulent activity, documenting identity theft, and understanding tools such as fraud alerts and credit freezes. Prompt action and awareness are critical.

Is credit education only for people with bad credit?

No. Credit education benefits anyone who wants to better understand credit, protect their financial profile, or make informed borrowing decisions—regardless of current credit standing.

Still have questions? Speak with a credit education specialist for clear, compliant guidance.

Ready to Rebuild Your Credit Today?

Legal Disclaimer

We provide credit review and dispute assistance services in accordance with applicable federal and consumer protection laws. Our role is limited to disputing information that may be inaccurate, incomplete, outdated, or unverifiable based on the information provided by the client.

We do not guarantee the removal of any specific item, credit score increase, or particular outcome. Items that are verified as accurate by credit bureaus or data furnishers may remain on the credit report.

Services include up to six (6) months of dispute support. Results vary based on individual credit profiles and third-party response timelines.

Options:

Get in Touch

Email: [email protected]

Customer Support: 📞Call Now

Whatsapp Us: https://wa.me

Address: 100 S Bedford Rd Suite 340, Mt Kisco, NY 10549, United States

Assistance Hours : Mon – Sat 9:00am - 7:00pm

Sunday – CLOSED

More Links