Contact Us:

Term Life Insurance

Term Life Insurance

When you have the intention of offering life insurance benefits to your loved ones in the unfortunate event of your untimely passing, it's understandable to feel overwhelmed by the variety of policy types and options that exist. In such cases, term life insurance can serve as a cost-effective method to provide financial security for a designated duration of time.

What Is Term Life Insurance?

Term life insurance coverage is precisely as its name suggests: life insurance designed for a specific duration known as the policy term. This coverage remains active for a predetermined number of years, typically ranging from 10 to 30 years, which you select when initially acquiring the policy. In the unfortunate event of your passing while the policy is in effect, the insurance company disburses the death benefits to the individuals you have designated as your beneficiaries.

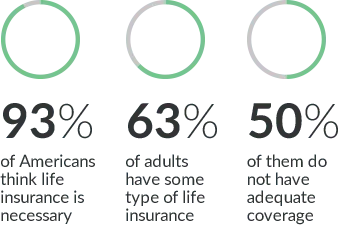

Why Do I Need

Term Life Insurance?

The primary motivation behind acquiring term life insurance is to offer reassurance and tranquility to your loved ones. Consider the possibility of your untimely demise – would your family be able to sustain their current lifestyle without financial strain? Term life insurance serves as a protective measure by providing a cash death benefit that can be utilized to cover various expenses upon your passing.

The funds from term life insurance can be allocated towards essential aspects such as final expenses, including funeral services, settling any remaining mortgage balance, securing children's education expenses, or ensuring the continuity of ongoing financial obligations after your demise. By having term life insurance in place, you can safeguard your loved ones from potential financial hardship and provide them with the support they need during a challenging time.

How Does

Term Life Insurance Work?

Similar to other forms of life insurance, term life insurance begins with an application for coverage through an insurance company. Once your policy is active and in force, you make regular premium payments on a monthly, quarterly, or annual basis to ensure continuous coverage. In the unfortunate event of your passing within the specified policy term, the insurance company disburses the predetermined death benefit amount to the individuals you have designated as beneficiaries.

Choose the Dickens Agency for Term Life Insurance

In the sea of insurance agents and brokers promoting their own company's life insurance policies. We distinguish ourselves as a truly independent insurance provider, granting us access to policies from more than 30 different life insurance carriers. This wide range of options empowers you to explore and discover the policy that perfectly suits your requirements.

We invest the necessary time to truly understand each client, their unique circumstances, needs, and goals before making any insurance recommendations. This client-centered approach enables us to serve you better by offering a diverse selection of coverage options and tailored solutions that precisely align with your specific needs.

Would You Like to Request a Quote?

Please fill out the form to receive personalized policy

options that align with your coverage and financial needs. Thank you.

Frequently Asked Questions

What are the advantages of Term Life Insurance?

Affordability stands out as a significant benefit of term life insurance. Insurance companies can provide term coverage at lower premium rates compared to permanent policies. This is because the likelihood of death within the policy term tends to be more favorable for the insurance company.

Additionally, term life insurance policies offer valuable flexibility, allowing you to adapt the coverage to your evolving needs. If you determine that permanent coverage is a more suitable option, many in-force term life insurance policies can be converted into permanent life insurance policies, providing you with extended coverage and added benefits.

Other advantages of term life insurance:

It can be used to supplement life insurance coverage provided by your employer

Policies provide a fixed death benefit for a time period that you choose up-front

In addition to the specified "face amount" death benefit, your policy may include a return of premium option

Some policies also offer other coverage options including critical illness and disability insurance protection

Undoubtedly, the range of policies and options available can be overwhelming. When contemplating the purchase of a term life insurance policy, it is crucial to consider your financial situation and carefully select coverage that aligns with your specific needs. By keeping your unique circumstances in mind, you can make an informed decision that provides the optimal level of protection and peace of mind for you and your loved ones.

Do I qualify for Term Life Insurance?

During the application process for life insurance, regardless of the type, you will be required to provide essential information about your health and lifestyle. Generally, individuals who are in good overall health will be eligible for coverage. Even if you have certain pre-existing health conditions, there is a possibility of qualifying for term life insurance, although it is important to note that your premium may be higher.

In certain cases, you may not be required to provide additional evidence of insurability beyond the application questionnaire. This means that you may not need to undergo a physical examination in order to qualify for coverage, depending on the specific policy you choose.

When should I buy Term Life Insurance?

The ideal moment to purchase term life insurance is the present. Life insurance aims to provide a cash death benefit to your designated beneficiary or beneficiaries upon your passing. As we cannot predict the exact timing of our demise or potential health setbacks, securing coverage while you are in good health is a sensible decision. Eligibility for term life insurance relies on your health at the time of application, reinforcing the importance of acquiring coverage now.

While it is our hope that your term life insurance policy remains unused, if the need arises, your loved ones will be grateful that you took the initiative to plan for insurance when you did. By prioritizing insurance planning in the present, you offer your family invaluable financial protection and demonstrate your foresight in safeguarding their future well-being.

Can I afford Term Life Insurance?

Term life insurance is typically the most cost-effective option among various life insurance types due to its specific coverage duration. The premium you pay for term life insurance is determined by your age when purchasing the policy and your overall health. Individuals who are non-smokers and in good health generally enjoy lower premium rates, allowing them to secure affordable coverage.

Would You Like to Request a Quote?

Please fill out the form to receive personalized policy

options that align with your coverage and financial needs. Thank you.

Eliminate Debt; Save For The Future

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry's standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries.