Contact Us:

RANKED AS THE PREMIER LIFE INSURANCE AGENCY

IN ROCKFORD, IL

Life Insurance

At the Dockins Agency, we want to make sure you have all the information you need to confidently make the best decisions for your family. We partner with over 30 insurance carriers so we can provide you with a completely customized plan, providing the coverage you need.

Whether you’re deciding between life insurance options, looking for mortgage protection, or considering final expense coverage, our agents are here to help you decide which insurance plan best fits your needs, and is well within your budget.

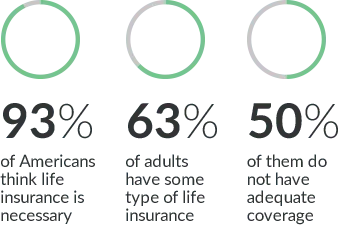

Why Do I Need Life Insurance?

In an ever-changing world, where life's uncertainties abound, it becomes essential to secure your family's financial well-being even in your absence. By acquiring a carefully tailored life insurance plan, you can find solace in the knowledge that your loved ones will be safeguarded from financial hardship. At our esteemed life insurance agency in Rockford, IL, we are dedicated to assisting you in obtaining the ideal coverage that meets your specific needs. Allow us to outline some of the key motivations for choosing a life insurance plan from the trusted life insurance agency in Rockford, IL.

Protect your family financially

Replace your income

Enjoy tax-free benefits

Receive potential dividends

Mortgage Protection Insurance

A home mortgage stands as the largest investment and monthly expense for most American families. Mortgage protection insurance goes beyond mere protection; it represents an investment in your family's future. By securing the right coverage, you can find peace of mind, knowing that your family's home will remain secure, even in the face of unforeseen tragedies.

Final Expense

Insurance

Final expenses encompass the financial obligations that arise upon a person's demise, such as burial expenses and medical bills. Final Expense refers to a whole life insurance policy specifically crafted to cover these costs upon the insured individual's passing. This insurance solution allows families to mourn their loved ones without the weight of substantial debts or unexpected expenses.

Term Life

Insurance

Term life insurance is widely recognized as the most cost-effective form of life insurance. It provides coverage for a predetermined duration of your choosing, typically ranging from 10 to 30 years, based on your age and health condition. Numerous term life policies can be obtained without undergoing a physical examination. We provide a range of term life options to ensure that the coverage you opt for aligns seamlessly with your specific requirements.

Universal Life

Insurance

Universal Life insurance is a form of permanent life insurance that offers adaptable premiums and adjustable benefits. Apart from its cash values, which can be utilized for purposes such as funding children's education, it can also serve as a supplementary source of retirement income and cover unforeseen expenses. This insurance plan is widely regarded as the most versatile option available within the realm of life insurance.

We Work With Companies You Can Trust

Would You Like to Request a Quote?

Kindly complete the brief form to enable us to offer you policy options that align perfectly with your coverage and financial requirements.